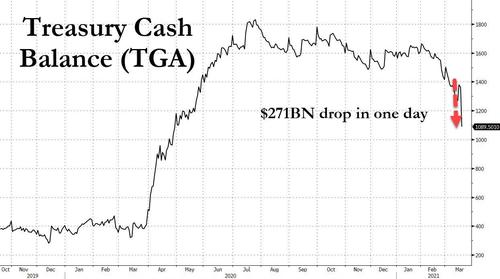

The Treasury has chosen to reduce issuance significantly, thereby further limiting liquidity growth. The Treasury’s issuance & cash management. The Fed can choose to begin outright sales of MBS securities, thereby matching the $95 billion cap for QT, or they can come in below the existing cap. The Fed’s pace of run-off/outright sales. Through our lenses, there are three major levers at play that will determine the ferocity of liquidity tightening: Periods of tightening liquidity create more difficult markets to maneuver through therefore, it makes sense to pencil in the degree of tightening we will likely witness. In truth, however, this isn’t an informative trading strategy (we have a host of tools to that end) but serves to establish context. We show a rough assessment of this below:Īs we can see above, periods of Reserve Drawdown tend to provide lower returns for incremental volatility relative to periods of rising reserves. QT period tends to have a volatility-generating effect, with average returns on equities and other “risk-on” assets reduced.

While reserve balances are not an impetus for financial institutions to lend/transact, they are vital for financial stability and liquidity conditions. The netting out of balance sheet factors determines the degree of reserve balances. The Federal Reserve’s balance sheet is of critical importance because it is a source of liquidity to the financial sector. Particularly, the Federal Reserve has already raised interest rates twice this year, and in June, they shall embark on the journey to reduce the size of their balance sheet, i.e., QT. Government policy tends to move countercyclically, and true to form, the US Sovereign is now withdrawing liquidity from the economy. These dynamics have also created a demand impulse, aggravating supply shortages and has resulted in a historical inflation acceleration. This massive liquidity injection led to one of the fastest ever economic rebounds, coupled with the frothiest equity markets in decades. The tone set by the US Sovereign typically sets the tone for financing conditions and thereby has significant economic and market impacts.īeginning in 2020, the Fed and Treasury embarked on one of the most extensive liquidity creation programs, in the form of Quantitative Easing and Fiscal Transfer Payments, by the Fed and Treasury, respectively. The most systemically important liquidity creator is the US Sovereign, i.e., the Federal Reserve and Treasury. We have always stressed that liquidity, i.e., a measure of the amount of financial dry-powder available to fund and finance economic activity, is a critical driver of both the economy and financial markets. Today, we take a detour from our systematic commentary to provide insight into the mechanisms at play in determining the severity of Quantitative Tightening (QT).

0 kommentar(er)

0 kommentar(er)